In 2009, the Children’s Health Insurance Program Reauthorization Act of 2009 (“CHIPRA”) increased and equalized federal excise tax rates for cigarettes, roll-your-own tobacco, and small cigars but did not equalize tax rates for pipe tobacco and large cigars (and kept them taxed at a lower rate). This created a significant tax disparity among different types of tobacco products.

In a 2012 report conducted by the United States Government Accountability Office (GAO), researchers found that tax revenue decreased after the law was passed, because manufacturers produced and consumers bought more of the lower-taxed products.

The inconsistencies and loopholes in the current federal tobacco tax code include:

- The federal tax on loose tobacco for pipe smoking is less than one-eighth the tax rate on loose tobacco used for rolling into cigarettes or cigars, which has led some manufacturers to re-label their RYO tobacco as pipe tobacco to qualify for the lower tax rate.

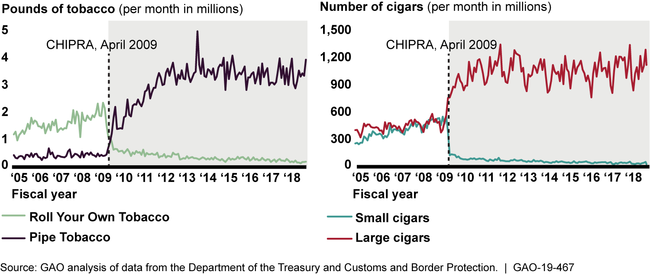

- In the twelve months after the 2009 rate increases created a disparity in tax rates between RYO and pipe tobacco, RYO tobacco sales dropped by 61 percent, but pipe tobacco sales increased by 233 percent compared to the same period the year before. This trend has continued each year following.

- The federal tax on large cigars is based on the price of the product (52.75% of the

manufacturer’s price) with a cap, compared to the tax on cigarettes and small cigars at $1.01 per pack of 20 sticks. Manufacturers modified their cigarettes and little cigar products to qualify for the lower tax rate on large cigars by slightly increasing their weight and, in the case of cigarettes, adding some tobacco into their wrapper paper. As a result, in the year after the tax increase, sales of products in the “small cigars” category dropped by 79 percent, while sales of products labeled and taxed as large cigars increased by 77 percent.

- The federal tax on a standard can of loose smokeless tobacco is less than one-eighth of the tax on a standard pack of cigarettes.

- The weight-based federal tax on snuff taxes low-weight smokeless tobacco products at a rate that is as little as one-eighth of the tax on regular loose moist snuff. As a result, the tax on each unit of these new low-weight smokeless products is as little as 1/70th of the tax on cigarettes.

Above is a chart created by GAO of U.S. Sales of Roll-Your-Own and Pipe Tobacco and of Small and Large Cigars, Both Domestic and Imported, before and after the Children's Health Insurance Program Reauthorization Act (CHIPRA) of 2009.

The GAO report found that federal revenue would likely increase if taxes were equalized because lower-taxed products still dominate their markets, as a result of consumer preference as well as manufacturers finding loopholes. GAO estimates that federal revenue losses range from a total of about $2.5 to $3.9 billion from April 2009 through September 2018, depending on assumptions about how consumers would respond to a tax increase. Federal revenue would likely increase if Congress were to equalize the tax rates. GAO estimates that federal revenue would increase by a total of approximately $1.3 billion from the fiscal year 2019 through the fiscal year 2023 if the pipe tobacco tax rate were equalized with the higher rate for roll-your-own tobacco and cigarettes.

In its 2012 report, GAO recommended Congress consider equalizing tax rates and the Treasury generally agreed with GAO's conclusions and observations. To date, Congress had not passed legislation to reduce or eliminate tax differentials between smoking tobacco products. The current federal tax rates for tobacco products produce inequities and loopholes that sharply reduce federal revenues. Manufacturers and consumers should be aware of how these tax inconsistencies affect them and their business.